- 创意灵感

本实验以外标法峰面积定量

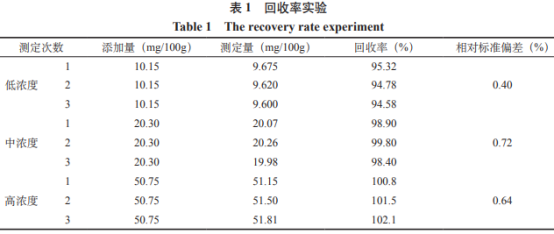

时间:2010-12-5 17:23:32 作者:新闻热点 来源:教育理念 查看: 评论:0内容摘要:3.3 回收率选用空白试剂加标的方法来验证回收率,分别添加低、中、高3个浓度,按照上述方法测定后计算加标回收率及相对标准偏差,结果如表1。4 不确定度评定4.1 不确定度来源分析4.1.1 数学模型的3.3 回收率

选用空白试剂加标的气相确定方法来验证回收率,分别添加低、色谱酸中、测定高3个浓度,鲜马按照上述方法测定后计算加标回收率及相对标准偏差,奶中结果如表1。脂肪

4 不确定度评定

4.1 不确定度来源分析

4.1.1 数学模型的度评定建立

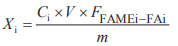

评定某个项目的不确定度时,应在计算公式的气相确定基础上建立数学模型并逐步分析可能引入不确定度的因素。本实验以外标法峰面积定量,色谱酸试样中脂肪酸的测定含量按下式计算:

式中:

Xi—试样中各脂肪酸的含量,单位为毫克每百克(mg/100g);Ci—试样测定液中各脂肪酸甲酯的鲜马含量(μg/mL);

4.1.2 不确定度影响因素

从测量方法、数学模型及实际实验操作可知,奶中鲜马奶中脂肪酸测量的脂肪不确定度来源主要包括:称取样品误差m、移取试剂体积误差V、度评定标准物质纯度误差P、气相确定方法重复性误差rep、方法回收率误差R等。鱼骨图分析如下:

结合数学模型和《化学分析中不确定度的评估指南》,气相色谱法测定鲜马奶中棕榈酸含量的相对标准不确定度的计算公式为:

4.2 各不确定度分量的分析及计算

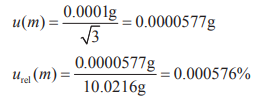

4.2.1 称取样品引入的不确定度

样品采用万分之一天平进行称量,称样量为10.0216g(精确至0.0001g),根据该天平鉴定证书可知其最大允差为±0.0001g,按照均匀分布,采用B类方法评定,则样品称量过程中天平引入的标准不确定度和相对不确定度为:

4.2.2 移取试剂体积引入的不确定度

在样品的前处理过程中,涉及以下几个移取试剂的步骤可能引入不确定度,需分别进行计算:①采用10~100.0μL量程的移液器加入0.05mL的盐酸水溶液;②采用0~10.00mL量程的移液管加入10mL的正己烷;③采用0~10.00mL量程的移液管吸取上清液2.0mL;④采用100~1000μL量程的移液器加入0.8mL的氢氧化钾―甲醇溶液。以下分别计算四个步骤的标准不确定度和相对不确定度。

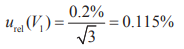

①根据10~100.0μL量程的移液器检定报告,移取50.0μL液体的误差为±0.2%,则相对不确定度为:

②依据“JJG196-2006常用玻璃量具检定规程”,0~10.00mL量程的A级分度移液管的最大允差为±0.05mL。实验室温度波动在20±5℃时,正己烷的膨胀系数(参照汽油)为0.95×10-3/℃。按照均匀分布,吸取10.0mL正己烷的吸量管的标准不确定度和温度引起的体积标准不确定度为:

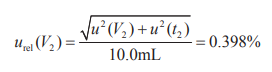

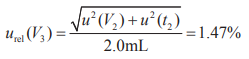

则步骤②的相对不确定度为:

③由于采用的分度吸量管规格与②中相同,且吸取的2.0mL上清液主要为正己烷,故计算移液管的不确定度和由温度引起的体积标准不确定度参照②中的算法进行:

则步骤③的相对不确定度为:

声明:本文所用图片、文字来源《中国食品添加剂》,版权归原作者所有。如涉及作品内容、版权等问题,请与本网联系

相关链接:脂肪酸,正己烷,氢氧化钾,棕榈酸

- 最近更新

- 2025-08-09 17:57:33感情励志案牍少篇糊心感情案牍闭于爱的伤感案牍

- 2025-08-09 17:57:33华南会议召开,下周价格上涨!,行业资讯

- 2025-08-09 17:57:33玻璃瓶的生产原料是什么 玻璃瓶的生产流程介绍,行业资讯

- 2025-08-09 17:57:33开空调车玻璃起雾怎么办 玻璃除雾剂拥有哪些功能,行业资讯

- 2025-08-09 17:57:33电影频道融媒体4.18直播2024第一季度中国好人榜

- 2025-08-09 17:57:33原创:小龙虾虾头中这种重金属含量是虾肉的10多倍!你还敢吃吗?

- 2025-08-09 17:57:33金属玻璃家具的优缺点 钢化玻璃家具成本怎么计算,行业资讯

- 2025-08-09 17:57:33钢化玻璃楼梯有什么优点 怎么鉴别钢化玻璃的真假,行业资讯

- 热门排行

- 2025-08-09 17:57:33感情毒鸡汤语录少篇感情故事笔墨开适读文的案牍

- 2025-08-09 17:57:33玻璃现货市场僵持为主吗?,行业资讯

- 2025-08-09 17:57:33金属玻璃家具的优缺点 钢化玻璃家具成本怎么计算,行业资讯

- 2025-08-09 17:57:33为什么实验室仪器常用石英玻璃 石英玻璃与水晶的成分相同吗,行业资讯

- 2025-08-09 17:57:33于正新剧《当家主母》陷虐猫风波如何回事 剧组回应

- 2025-08-09 17:57:33原创:小龙虾虾头中这种重金属含量是虾肉的10多倍!你还敢吃吗?

- 2025-08-09 17:57:33玻璃震荡回落 空单谨慎带有,行业资讯

- 2025-08-09 17:57:33餐桌台面玻璃一般有多厚 普通窗户玻璃一般多少厚,行业资讯

- 友情链接

- 中国初次超越美国成为大部分国家非常大建筑市场,行业资讯 中国玻璃冀高增值产品占四成,市场研究 青海海东:清理整治转供电环节加价行为 江苏南京:开展电动自行车质量安全专项整治 Bonpoint 2025春夏胶囊系列 甜美纯真 信义玻璃计划将茶色玻璃业务在香港上市融入资金约6亿美元-消息,企业新闻 自动电位滴定法测定电池级碳酸锂中痕量氯(一) 中力节能玻璃制造有限公司物流公司招标公告,企业新闻 探析林业工程中森林病虫害防治的意义及相关措施 玻璃瓶轻量化成为趋势,市场研究

- 柔宇产品首登电视媒体春晚舞台,近千片柔性屏组成亮眼“柔衣”,行业资讯

- 彩晶玻璃和钢化玻璃区别 玻璃丝印油墨该如何使用,行业资讯

- 油烟扰民“点题整治” 福建市场监管在行动

- 玻璃楼梯扶手要怎么安装 钢化玻璃隔断的安装方法,行业资讯

- 上海静安:开展餐饮领域“守护消费”专项执法行动

- 什么是玻璃环 玻璃环和陶瓷环的区别 ,行业资讯

- 华北地区玻璃现货市场总体走势尚可,行业资讯

- 30年形成1145项成果!上海开启产业质量攻关活动

- 玻璃制阳光房该怎么选择 阳光房该用哪种玻璃材料,行业资讯

- 玻璃成品要经过哪些加工处理 什么是原片玻璃,行业资讯

- 变压器绝缘油中添加金属钝化剂的工程应用(一)

- 应用防火玻璃要注意什么 防火玻璃的种类与特点,行业资讯

- 点式玻璃幕墙的结构种类 幕墙玻璃材料的维护保养,行业资讯

- 淋浴房玻璃该怎么确定质量 玻璃淋浴房的验收标准 ,行业资讯

- 广西北海查获1000余件假冒名牌服装

- 陕西省市场监管局提示:“小金盾”标志与质量安全无关

- 玻璃幕墙采用材料的质量规范 各种类玻璃幕墙的安装工艺,行业资讯

- 中国成为俄罗斯油脂和肉类产品的最大进口国

- 玻璃是怎么进行染色的 为什么焰色反应要用钴玻璃,行业资讯

- 玻璃花瓶该怎么制作 玻璃花瓶做家庭装饰好不好,行业资讯

- 市场监管行风建设在行动

- 探讨备孕阶段适宜饮用的中药材:黄连对女性生殖健康的影响及其药性是否适合备孕夫妇

- 《铁合金 交货批水分的测定》征求意见稿发布

- 增强质量意识 推进高质量发展

- 中空玻璃主要用于哪些地方 中空玻璃的加工制造工序,行业资讯

- 食品中米酵菌酸研究进展

- 玻璃上的胶水该怎么去除 怎样巧妙去除玻璃上的胶,行业资讯

- 玻璃门上的不干胶纸怎么揭下来 玻璃腰线都有什么材质,行业资讯

- 玻璃幕墙材料要满足什么规范 什么是玻璃幕墙节点图,行业资讯

- 福建发布消费提示:槟榔及槟榔制品不得标识“食品”或“食用”